The Material and Carbon Footprint of Machinery Capital: A Dual Role in Climate Change

by Meng Jiang and Edgar Hertwich

Our world is increasingly mechanized, with machinery and equipment being integral to both industrial processes and our daily lives. From agricultural machines to advanced technology like graphics processors and renewable energy tools like solar panels, machinery is ubiquitous. Machinery capital is essential, yet research in Environmental Science & Technology indicates that its manufacturing process alone contributes to significant carbon emissions and entails heavy consumption of metals and materials.

The Carbon and Material Footprint of Machinery

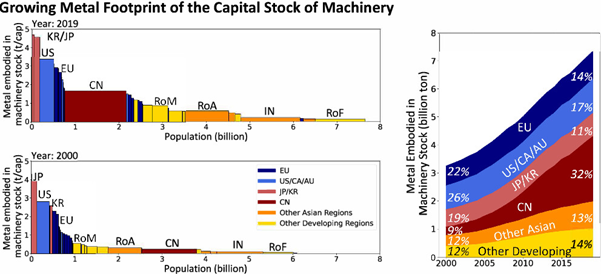

In this study, we integrated input-output analysis with dynamic material flow analysis to understand the material and carbon footprints of machinery. In 2019, machinery production required 30% of global metal production and contributed to 8% of global carbon emissions. Moreover, from 2000 to 2019, the metal footprint of machinery stocks grew at a rate twice that of the global economy.

The complexity of machinery's role in climate change is highlighted. On one hand, machinery is crucial for climate mitigation technologies and services, but on the other, its production and lifecycle are heavily carbon-intensive.

Key Findings and Global Implications

A detailed breakdown of the carbon footprints associated with machinery production is presented, along with a regional comparison of carbon, material, and metal footprints within machinery and equipment capital stock.

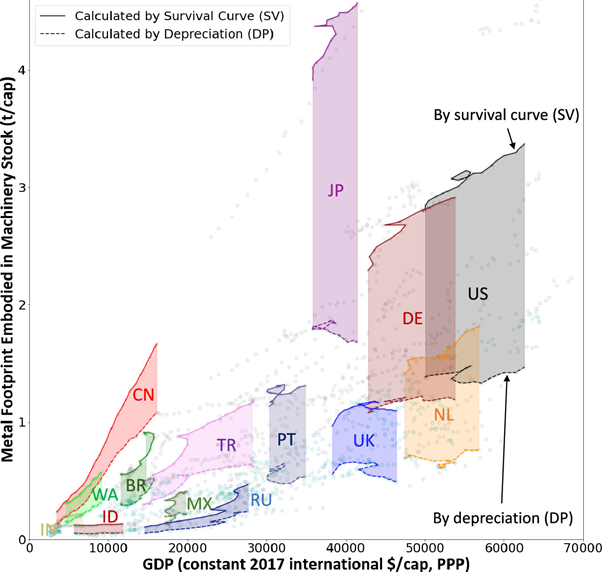

Industrialized countries use 2−4.5 tons of metals per capita to build their stock of machinery and equipment, while many developing countries dispose only of a tenth of that amount.

To illustrate the global implications and scale, we spotlight key countries. Around 2008, China's total machinery capital stock, indicated by the metal footprint of machinery stock, exceeded that of the United States. By 2019, it had doubled, though its per capita level still remained at only half of that in the US.

The growth rate and absolute increase in developing regions significantly surpassed those in developed countries. Consequently, the share of advanced economies in the global material footprint of machinery stock declined from 51% to 34%. This shift was more pronounced in machinery used in production industries (extraction, manufacturing, and machinery), where in 2019, advanced economies accounted for only 24% of the worldwide share, a decrease from 45%.

Towards a Circular Economy

We discuss the concept of depreciation in the financial sector and its discrepancy with the actual service life of physical machinery. For instance, a five-year-old car might lose half its value on the book, but more than 50% of such cars are still in use. It indicates that the physical assets continue to serve long after their book value has depreciated.

Understanding the relationship between a machine's tangible value and its environmental impact is vital for both financial and environmental strategy. For instance, in scope 3 emissions accounting, the methodology a company uses to calculate capital-related emissions greatly affects reported data and shapes responsibility allocation.

Our findings point towards an essential transition: as physical machinery stocks saturate, new machinery can increasingly be built from metals recycled from retired machinery. This shift is vital for moving towards a more sustainable and circular economy, where waste is minimized and resources are reused efficiently.

Conclusion

Machinery holds a dual role in the battle against climate change. As an essential component of industrial and daily life, its environmental impact is also significant. The presented analysis lays the foundation for future research and policymaking. It underscores the importance of devising strategies that balance machinery's utility with its environmental footprint. This serves as a call to action for industries and policymakers to harmonize the advantages of machinery with the imperative of sustainability.

Article link : https://pubs.acs.org/doi/10.1021/acs.est.3c06180